Executives in Hong Kong's financial services sector landed some of the highest 2010 bonus payments the world over. But what was a lavish gratuity for some came as a slap in the face for others.

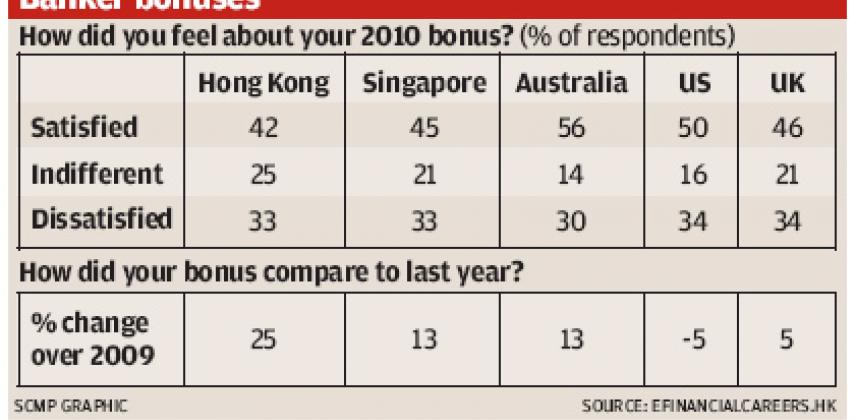

A recent survey by eFinancialCareers found that 58 per cent of finance staffers were less than satisfied with the latest round of payments, which on average were 25 per cent higher year-on-year. Adding to the dissonance, the annual increase was in sharp contrast to those in other markets, such as Singapore and Australia, both of which saw a rise of just 13 per cent.

The company's Asia-Pacific head, George McFerran, attributes the varying increments to geography, market activity and company structure.

"Singapore, for example, tends to be more of a back-office environment where bonuses are smaller and don't make up a significant part of the remuneration package," he says. "Hong Kong, on the other hand, is more weighted towards the front-office." He says the city's proximity to the mainland is also a key factor, as is its robust initial public offerings market.

In terms of the satisfaction gap, which included a 33 per cent rate of dissatisfaction, McFerran stops short of providing a definitive explanation, owing to the limited scope of the survey, but points to the possibility of a perceived lack of profit-sharing after what was undoubtedly a banner year for the industry.

If proven correct, this could adversely affect the ability of companies to keep their top performers on deck, a prospect that looks likely, as 58 per cent of survey respondents said they planned to switch jobs in the coming year. "Retention is going to be much higher on the agenda than before," McFerran says.

But while this could prompt even bigger bonuses in the short-term, particularly in areas with skills shortages, hard cash is far from the only means of keeping staff. "Career development and the opportunity to learn and be promoted are key to retention," McFerran says. "Providing people with relevant training and offering them clear career paths is the most important part of this."

He suggests talking to staff to determine the importance they place on non-financial rewards, such as a company's environmental awareness or its corporate social responsibility efforts. Where financial rewards must be used, McFerran raises the possibility of higher base salaries - an approach that's already gaining wide appeal in the United States and Europe, largely due to upcoming legislative changes, particularly taxes on bonuses. He also notes the increased adoption of deferred payment agreements, which can help lock in people to longer stints.